If you’re a new entrepreneur in Texas, you’ve probably wondered how to avoid the self-employment tax of about 15.3%. For any new sole proprietor or small business owner, this rate may come as a big surprise.

Many Texas entrepreneurs often ask us how they can evade this tax legally. What we tell them is that the right question is: “How can I lower my overall tax liability?”

As a CPA firm in Houston, we tell our clients that they have to be proactive business owners and keep their finances organized for tax deductions.

So, if you’re looking for legitimate ways to manage your self-employment tax, here are some smart insights from Dabney Tax & Accounting Services.

What Exactly Is Self-Employment Tax?

Before we talk about reducing it, let’s quickly break down what the self-employment tax is. It’s a 15.3% tax on your net business earnings, composed of two parts:

- 12.4% for Social Security

- 2.9% for Medicare

This tax is essentially the employee and employer portion of FICA taxes combined. W-2 employees have this split with their company, but as a business owner, you’re responsible for the whole thing. This applies to you if you’re a sole proprietor or an active member of a partnership or a standard limited liability company (LLC).

The most important thing to remember is that this tax is calculated on your net business income, not your gross revenue. This is a crucial distinction that leads us to our first strategy.

How to Avoid Self-Employment Tax with Deductions

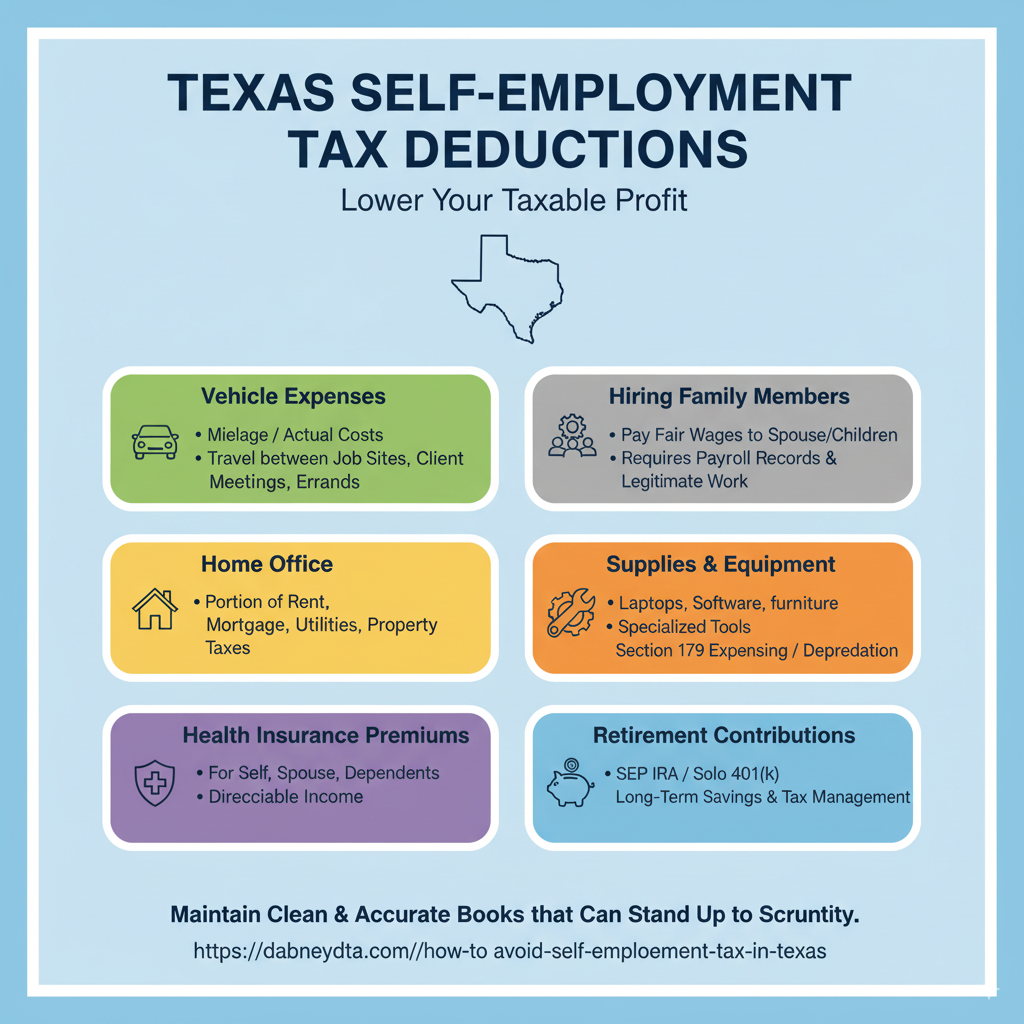

Since the tax is based on your net profit, every legitimate tax deduction you claim directly reduces it. The more qualified business expenses you meticulously track, the lower your taxable profit will be. This is the most straightforward way to manage your self-employment tax burden.

This is about more than just finding receipts at the end of the year; it’s about building a robust, defensible record of your business activities throughout the year. Common deductions for a Texas small business include:

- Vehicle Expenses: The cost of driving between job sites in the Houston metroplex or to meet clients in Dallas.

- Home Office Deduction: It’s a deduction for the portion of your home used solely and regularly for your business.

- Supplies and Equipment: Everything from the software you use to the specialized tools you need for your trade.

- Health Insurance Premiums: A key tax deduction for many self-employed individuals.

- Retirement Contributions: Contributing to a SEP IRA or Solo 401(k) lowers taxable income while also building long-term savings.

- Hiring Family Members: If your spouse or children work in your business, paying them a fair wage shifts income from your self-employment tax base.

The goal isn’t just to figure out how to avoid self-employment tax, but how to do so with clean, accurate books that can stand up to scrutiny. Every dollar you claim as a legitimate business expense is a dollar that isn’t subject to that 15.3% tax.

Using an S-Corp to Avoid Self-Employment Tax on Profits

This is often one of the most effective structural strategies for a profitable small business. An S-Corporation is a tax election that allows you to split your business’s income into two types: a salary and distributions. This can be really helpful for your tax liability.

So, how to avoid self-employment tax using an S-Corp? Let’s take a look at it in simple terms:

- You Pay Yourself a “Reasonable Salary”: As the owner-employee, you set a reasonable salary for the work you perform, which is subject to FICA taxes similar to self-employment tax.

- You Take the Remaining Profit as a Distribution: Any business profit left after you’ve paid your salary and other business expenses can be paid out to you as a shareholder distribution. These distributions are not subject to the 15.3% tax.

The key to this entire strategy is determining and paying yourself that “reasonable salary.” The IRS requires this to prevent business owners from paying themselves a tiny salary (like $10,000) and taking the rest as a tax-free distribution. This is where professional guidance is essential to stay compliant.

Why Get Professional Support for Self-Employment Taxes

A successful marketing consultant in Houston just recently worked with us, who was operating as a single-member limited liability company. The net income from her business was consistently high. This meant that her self-employed tax bill had a substantial value.

After analyzing her finances, we conducted her through the S-Corp election process. We helped her search and document a reasonable salary for a marketing director in our geographic location.

What she paid herself as that salary and the rest from the profit as a distribution meant that she could significantly lower her overall tax liabilities. A perfect example of legal ways to structure tax management on business profits is through smart, compliant structuring.

So, How to Avoid Self-Employment Tax?

While you can’t simply opt out of self-employment tax, you have significant control over how much you pay. By diligently tracking every tax deduction and, when your business is ready, adopting a more tax-efficient structure like an S-Corporation, you can legally reduce your burden.

These strategies are not about finding loopholes; they are about using the tax code as it was designed for a small business owner.

Ready to build a smarter tax plan? If you’re a Texas business owner looking for guidance on structuring your business for better tax outcomes, the CPA-led team at Dabney Tax & Accounting Services can help. Contact us today to discuss your financial situation and see how we can support your goals.

FAQs About Self Employment Tax

How do I determine a "reasonable salary" for my S-Corp?

A reasonable salary is what a similar business would pay someone to do your job. Factors include your experience, your duties, and what businesses in your geographic location pay for similar roles. A CPA can help you research and document this figure using data from salary websites, industry reports, and professional experience to support your position.

What’s the difference between a limited liability company (LLC) and an S-Corp?

An LLC (Limited Liability Company) is a legal entity created by the state of Texas that provides liability protection for a small business. An S-Corp is a tax election you make with the IRS. Any LLC can choose to be taxed as an S-Corp, which allows for the salary/distribution structure that can help manage your tax liability.

At what income level should I consider an S-Corp election?

There’s no magic number, but once your net business income consistently exceeds your reasonable salary plus the additional costs of payroll and compliance, it may be time to evaluate an S-Corp. A CPA can help you run a break-even analysis to see if the tax savings would outweigh the administrative costs.

Does claiming more business expenses increase my audit risk?

Claiming all of your legitimate business expenses is your right as a taxpayer. The key is meticulous documentation. Increased audit risk usually comes from claiming deductions that are unusually high for your industry or that you can’t substantiate with receipts, logs, and a clear business purpose, not from claiming every tax deduction you are entitled to.