For many Texas entrepreneurs, the line between personal finances and business finances can become blurred. A small business often represents both a source of income and one of the owner’s most meaningful long-term assets. Understanding this connection is an important part of financial planning for small business owners.

At our Houston CPA practice, we often see that successful small business owners benefit from a coordinated approach that considers both personal and business needs together. This is less about maintaining two separate financial plans and more about building a framework where each supports the other.

This guide focuses on a CPA-led perspective for integrating these financial areas. Rather than offering generic budgeting suggestions, it outlines considerations that may help Texas business owners create a clearer foundation for both their business and personal finances.

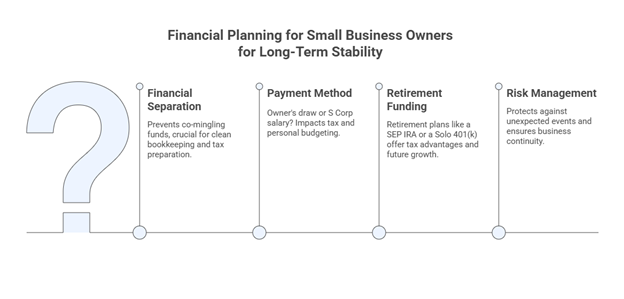

The Must-Haves of Financial Planning for Small Business Owners

A helpful early step in developing a unified financial plan is separating personal and business finances. While this may seem counterintuitive, keeping financial activity organized may make it easier to understand each area clearly. This separation can help create clearer bookkeeping records and may support more consistent reporting.

Here are some common starting points:

- Establishing Separate Accounts: Many small business owners open a dedicated business checking account and a business credit card. Having business income deposited into a business account and paying business expenses from the same source may help reduce co-mingling and make bookkeeping and tax preparation more straightforward.

- Maintaining Clean Books: Organized financial statements, such as a Profit & Loss statement and Balance Sheet, may help business owners review trends, see changes over time, and understand general profitability. The Small Business Administration (SBA) frequently emphasizes the importance of organized books as part of responsible business management.

Our bookkeeping services help support this foundation by organizing financial data in a clear and consistent manner, which may help business owners review their financial information more easily.

The Core Strategy of Paying Yourself with Purpose

How money moves from a business to the owner’s personal finances is often a key part of long-term planning. Different approaches may have different bookkeeping or tax implications, so understanding the basics can be helpful.

How Does this Strategy Work?

We recently met with a Houston-based graphic designer who took periodic draws from her LLC. As her income grew, it became harder for her to predict her tax obligations. After reviewing her financials, she spoke with her legal and financial advisors about whether an S-Corp tax election might be appropriate. Once she completed that process, we helped her understand the related tax reporting requirements and how payroll withholding could help her plan her budget more systematically.

In her situation, shifting to a salary-plus-distribution structure may have helped her better anticipate tax payments and plan her personal budget, depending on her income patterns. Each financial case is unique, so results can vary depending on income stability, business structure, and long-term goals.

A Long-Term Approach to Financial Planning for Small Business Owners

Once financial separation and compensation strategies are in place, many business owners explore ways their business may help support long-term financial goals.

Using Your Business to Fund Retirement

Small business owners have access to several retirement plan options, such as SEP IRAs or Solo 401(k)s, that may offer higher contribution limits than standard IRAs, depending on plan type and IRS guidelines.

These plans offer potential benefits:

- Contributions may be deductible for the business, depending on the plan type and IRS rules.

- Funds grow in tax-advantaged accounts, subject to IRS rules.

The IRS publishes annual contribution limits for each plan type, which can help business owners determine what may be available for their situation.

How to Protect Your Business (and Yourself)

Risk management is another important part of financial planning. This may include reviewing insurance coverage, establishing basic contingency plans, or documenting a high-level succession outline. These measures may help reduce certain disruptions that could affect long-term financial stability.

The Bottom Line

Financial planning for small business owners in Texas often involves creating a coordinated strategy that connects the needs of the business with the goals of the individual. By organizing financial accounts, selecting an appropriate compensation method, and exploring retirement and protection strategies, owners can begin developing a framework that may support sustainable growth.

If you’re a Texas business owner interested in understanding how proactive financial planning may support your long-term goals, contact the CPA-led team at Dabney Tax & Accounting Services to discuss the considerations involved.

Frequently Asked Questions

1. What is the 50/30/20 rule for small businesses?

Some business owners reference versions of the 50/30/20 approach as a general framework, allocating portions of revenue toward operations, growth, and savings or debt repayment. This is a general framework and may vary based on industry and business needs.

2. How can someone create a financial plan for their small business?

Many owners begin by reviewing financial statements, projecting cash flow, setting savings priorities, and considering tax and retirement planning options. Working with a CPA can help clarify how these elements fit together.

3. What are the 7 pillars of financial planning?

Common areas include cash flow analysis, risk management, investment planning, tax planning, retirement planning, estate considerations, and personal financial goals. For business owners, the health of the business may influence each pillar.

4. Is paying a 1% fee to a financial advisor worthwhile?

The value of an advisor depends on the services they provide. Reviewing the scope of work and fee structure may help determine whether it aligns with your needs.

5. How much does a financial advisor cost?

Financial advisors may charge based on assets under management, hourly fees, or flat-fee planning packages. Costs vary depending on complexity and service level.