During a difficult time, receiving an inheritance can create both emotional and financial questions. One of the most common is: do you pay taxes on inheritance?

In our Houston CPA practice, we hear this question often, and the answer is usually reassuring for beneficiaries. Most people searching ‘do you pay taxes on inheritance’ are confused because the tax treatment depends on the type of asset, not the amount received.

In most cases, the act of receiving an inheritance is not taxable income to the recipient. However, the tax obligations that come after you receive the asset, such as when you sell it or withdraw from a retirement account, still matter for long-term planning. For Texans, the situation is even simpler because the state imposes no inheritance tax.

This guide breaks down what beneficiaries need to know, the difference between inheritance and estate taxes, and how inherited assets may be taxed in the future.

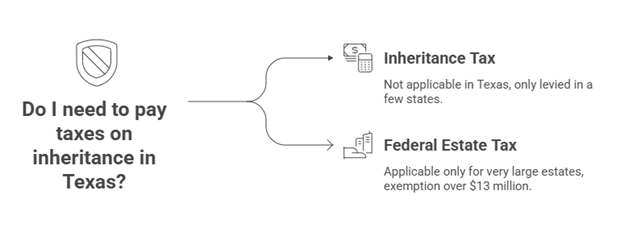

Inheritance Tax vs. Federal Estate Tax

Much of the confusion around “do you pay taxes on inheritance?” comes from similar-sounding terminology. When people search for “do you pay taxes on inheritance,’ they often confuse inheritance tax with estate tax. Here’s how they differ.

| Tax Type | Who Pays? | Does It Apply in Texas? | Key Detail |

| Inheritance Tax | The beneficiary receiving assets | No | Only a few states charge this tax (e.g., PA, NE) |

| Federal Estate Tax | The estate, before assets pass to heirs | Yes, but only for very large estates | Federal exemption is high (over $13M per person in 2024) |

Because Texas does not impose an inheritance tax, and because federal estate tax only applies to extremely large estates, most Texans never encounter either tax.

So, Do You Pay Taxes on Inheritance When You Receive It?

For most asset types, the answer is no. Inheriting:

- Cash

- Real estate

- Stocks

- Jewelry

- Business interests

…does not create taxable income on your personal tax return. The IRS does not treat inherited property as income.

This is the straightforward response to “do you pay taxes on inheritance?”:

You generally do not pay income tax simply for receiving an inheritance. The real tax questions begin when you sell, withdraw, or earn income from what you inherited.

The Exception of Inherited Retirement Accounts

Pre-tax retirement accounts operate differently.

If you inherit a:

- Traditional IRA,

- 401(k), or

- other pre-tax plan,

the funds inside were contributed without being taxed. When you withdraw inherited funds, those distributions become taxable income to you.

The timing and withdrawal rules depend on several IRS factors. Because these regulations are complex, beneficiaries often benefit from consulting a CPA before taking action.

How Inherited Assets Are Taxed When You Sell

Even though receiving an inheritance is not taxable, selling it may create a taxable event. This is where the stepped-up basis rule becomes extremely important.

How Stepped-Up Basis Works

When you inherit a property, the IRS resets your cost basis to the property’s fair market value on the date of death.

Example

- Your grandfather bought stock for $10,000

- At the time of his passing, the stock was worth $100,000

- You inherit it with a cost basis of $100,000

- If you sell it later for $110,000, you owe capital gains tax only on the $10,000 increase while you owned it

The $90,000 of appreciation during his lifetime is effectively removed for tax purposes.

This rule applies to most inherited assets, including real estate.

So, Do You Pay Taxes on Inheritance?

Not when you receive it. But taxes may arise later, depending on what you do with the inherited property.

Understanding stepped-up basis, retirement account rules, and potential income produced by inherited assets can help you better understand potential tax implications and make informed decisions. Beneficiaries often benefit from CPA guidance to avoid unexpected tax outcomes as they tackle these decisions.

If you recently inherited assets and need clarity, the CPA-led team at Dabney Tax & Accounting Services can help you evaluate your next steps and understand your tax responsibilities.

Frequently Asked Questions

1. Do I need to report inheritance money to the IRS?

Generally, no. Cash and property you inherit are not considered taxable income, so you do not need to report them on your personal tax return. The major exception is distributions from inherited pre-tax retirement accounts (like a Traditional IRA), which you must report as income.

2. How much can you inherit tax-free in Texas?

As a beneficiary in Texas, there is no limit to how much you can inherit tax-free. Texas does not have a state inheritance tax. Any potential tax obligation falls on the estate itself, but the vast majority of estates are not subject to estate tax due to the high federal exemption.

3. How much money can you inherit without paying federal taxes?

From the beneficiary’s perspective, there is no federal limit. You can inherit cash or property of any value without paying a federal inheritance tax because one does not exist. The person giving the inheritance might have their estate pay a federal estate tax, but only if their total estate is worth more than the federal exemption amount (over $13 million in 2024).

4. Does inheritance count as income in Texas?

No. Neither Texas nor the IRS considers the receipt of an inheritance to be taxable income. It is treated as a transfer of assets. Any income those assets later produce (like rent from an inherited house) is, however, taxable.

5. Do you have to pay taxes on money received as a beneficiary in Texas?

Generally, you do not have to pay taxes on inheritances when you receive them in Texas. The only common scenario where you would pay income tax is when you take distributions from a pre-tax retirement account you inherited.