When managing taxes, many individuals and small business owners wonder whether to hire a CPA vs tax preparer. While both professionals can help with taxes, their areas of expertise and the scope of services differ.

In this guide, we will explain the distinctions, discuss scenarios for each type of professional, and share a Houston-based case example to illustrate real-world applications. By understanding the differences, you may feel more confident in making a decision that suits your financial needs.

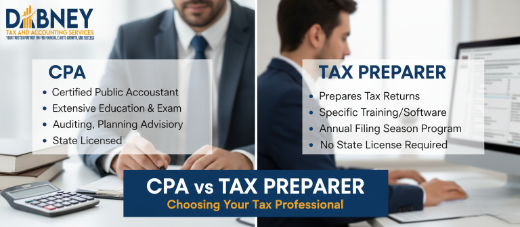

Understanding CPA vs Tax Preparer Roles

A CPA (Certified Public Accountant) is a licensed professional who meets strict educational, examination, and experience requirements. CPAs may handle business accounting, complex reporting, and tax matters, and more complex tax matters.

On the other hand, a tax preparer may focus primarily on preparing and filing tax returns. While some hold credentials like Enrolled Agent (EA), many handle only basic filings for individuals or small businesses. Tax preparers usually do not provide ongoing financial guidance beyond preparing your annual return.

For many Houston residents with W-2 income and standard deductions, a tax preparer may be sufficient. However, business owners, property investors, or those with multiple income streams often benefit from the broader support a CPA provides.

Further, IRS taxpayer advocate data indicates that certain credits, like the Earned Income Tax Credit, are more often adjusted after audit when returns are prepared by non‑credentialed preparers, showing credentialed professionals may help mitigate common error risks.

Key Differences Between CPAs and Tax Preparers

Understanding the distinctions may help you determine which professional fits your needs:

- Credentials and Scope: CPAs may meet rigorous requirements, including 150 college credit hours, the CPA exam, and relevant work experience. They may handle financial reporting, audits, and strategic tax guidance. Tax preparers vary widely. Some may hold EA certification, while others may focus strictly on filing returns.

- Tax Professional Credentials: CPAs and Enrolled Agents assist with IRS examinations or tax disputes. In contrast, non-credentialed tax preparers have more limited roles in these matters.

- Cost and Availability: Tax preparers are usually seasonal and more affordable. CPAs may charge higher fees due to broader expertise, but they are available year-round for ongoing business accounting, payroll, and financial management.

- Broader Services: CPAs often provide a wider range of financial support, including tax planning, financial analysis, and business record management, while most tax preparers focus on filing returns.

When a Tax Preparer May Be Sufficient

For many Houston taxpayers, finances are straightforward: W-2 income, standard deductions, and some basic investments. In these cases, a tax preparer may help organize documents, prepare returns, and assist in compliance with federal and state regulations.

Even for small service businesses, a tax preparer may handle annual filings effectively, especially if the business does not have payroll complexities or multiple revenue streams.

When a CPA Could Be More Appropriate

CPAs may provide additional support in more complex financial situations. Examples include:

- Business owners managing multiple income streams or payroll

- Individuals with multi-state income, rental properties, or investments

- Taxpayers seeking guidance on tax planning for audits

In Houston, business owners may also consider partnering with an experienced bookkeeping firm that may assist in keeping records organized.

Real-World Houston Case Study

A consulting firm in Brays Oaks had multiple income streams, including service contracts and a small rental property. Initially, they worked with a tax preparer, but as the business grew, they needed ongoing guidance for payroll, reporting, and compliance.

To support consistent reporting, the business worked with a qualified tax professional. The CPA coordinated with the team to review financial statements, suggest adjustments, and maintain well-organized records, all while providing high-level guidance. This example shows how a CPA and complementary services may work together to manage complexity.

Additional Financial Oversight

As a business expands, some clients seek broader oversight for long-term financial management. Partnering with experienced accounting and reporting support may help maintain consistent reporting, track trends, and support informed decisions.

In this scenario, the CPA collaborated with these services to provide structured guidance while keeping advice compliance-safe and focused on operational needs. Houston businesses balancing multiple revenue streams may find this combination particularly useful.

Factors to Consider When Choosing

- Assess Financial Complexity: List your income sources, investments, and business activities. The more complex your finances, the more a CPA may support your needs.

- Define Your Goals: Are you focused solely on filing taxes, or do you need ongoing business accounting, payroll support, or strategic insights?

- Check Credentials and Experience: Ask professionals about CPA or EA certifications and experience handling similar situations.

- Consider Cost vs. Services: Tax preparers may be a better option for simple returns, while CPAs provide year-round oversight and broader financial support.

FAQs

Frequently Asked Questions

1. What can a CPA do that a tax preparer cannot?

A CPA may perform financial audits, prepare detailed statements, and provide guidance on complex financial matters. Tax preparers primarily focus on return preparation.

2. Are CPAs worth the cost?

Yes, for individuals or small businesses with complex finances, CPAs provide structured oversight and support for payroll, multi-stream income, or audit questions.

3. How do I know if I need a CPA or a tax preparer?

Consider the complexity of your finances, business operations, and long-term goals. Multiple income streams, audits, or payroll needs often point toward a CPA.

4. What types of IRS issues can a CPA assist with?

Yes, a CPA can handle a variety of IRS matters, including reviews, audits, and responding to inquiries, while non-credentialed preparers may have limited authority.

Making the Right Choice

Choosing between a CPA vs tax preparer depends on your financial situation, goals, and support needs. Simple returns may be handled by a tax preparer. For multi-stream business income, payroll oversight, or ongoing financial reporting & analysis, a CPA may provide broader, year-round support.

If you are a Houston business owner or professional exploring these options, our team at Dabney Tax & Accounting Services may help. Working with us may help you manage your taxes and financial records more effectively with guidance and support throughout the year.