If you’re launching a startup in Texas, you’re likely focused on product development, customer acquisition, and securing early funding. One area that often receives less attention is the financial foundation that keeps everything running: accounting systems for startups.

At Dabney Tax & Accounting Services, we’ve worked with founders across Houston, from energy tech and logistics to healthcare and e-commerce. We’ve seen how unclear or inconsistent accounting early on may create challenges later in the startup lifecycle.

Organized accounting records aren’t just for tax filing. They can support clearer cash-flow visibility, provide useful information that may be referenced during investor discussions, and help founders review their financial position as the company grows.

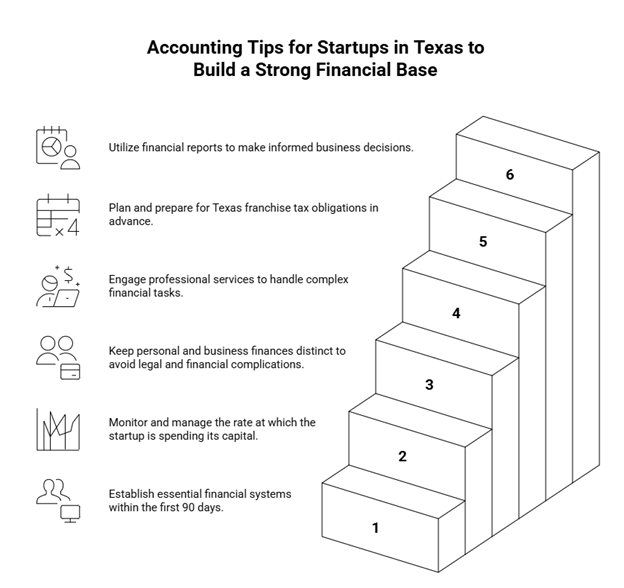

So, here we’ll take a look at the most overlooked accounting tips for startups.

Why Most Founders Underestimate Accounting Matters

Many early-stage founders think accounting is something to revisit “later,” once revenue increases. But in Texas, where many startups operate with lean capital, waiting too long can create operational and compliance issues.

For example, we met with a medtech founder in The Woodlands who postponed setting up formal books for several months. When he eventually needed financial documentation for investor discussions, it became difficult to separate operating costs, understand burn rate, or categorize expenses properly.

Financial activity begins on Day One: legal fees, software subscriptions, contractor payments, and early development costs. Without a clear system, these expenses may merge into personal spending, creating confusion or complications later.

Set Up Your Financial Foundation in the First 90 Days

The early months of a startup often set the tone for long-term financial organization. Establishing structure early may help reduce bookkeeping inconsistencies and support more organized tax preparation later.

Some common early steps include:

- Opening a dedicated business bank account

- Choosing a cloud-based accounting platform (e.g., QuickBooks, Xero)

- Setting up a chart of accounts tailored to your industry

- Linking business credit cards and bank feeds

These steps may help you maintain organized records and gain early visibility into business financial health.

A Dallas-based SaaS startup we supported had its books organized from the beginning. When they later applied for financing, the organized records made their financing application process more straightforward. Our Bookkeeping & Payroll Services help clients create consistent processes from the start.

First 90 Days Financial Checklist for Startups

| Task | When to Complete | Why It’s Important |

| Choose legal entity (LLC, C-Corp) | Day 1–7 | Helps inform tax and liability considerations (consult legal counsel) |

| Open a business bank account | Day 1–14 | Helps separate personal and business finances |

| Select accounting software | Day 1–21 | Centralizes and organizes financial data |

| Record all startup costs | Ongoing | Helps track deductible expenses |

| Set up monthly reporting | Month 1 | Provides visibility into P&L, balance sheet, and cash flow |

| Review burn rate & runway | Month 2–3 | Supports capital planning and spending decisions |

Know and Track Your Burn Rate

In Texas, where venture funding is growing but still selective, knowing your burn rate is essential.

Burn rate reflects how quickly you’re spending cash each month. It helps estimate runway and may inform planning around hiring, product development, and fundraising.

Here’s a formula that you may use to estimate burn rate:

| Total cash / Monthly operating expenses = Runway (in months) |

We reviewed the books of a Houston energy-tech startup and identified duplicate SaaS subscriptions that increased expenses without providing additional value. Regular review of financial statements may help highlight areas where spending patterns have changed.

Separate Personal and Business Finances

One of the more common challenges we see among new founders is the use of personal cards for business purchases. Mixing funds can make it harder to track expenses, evaluate the business’s financial health, or prepare organized tax filings.

Opening a business checking account and corporate card, and using them exclusively for business activity, can support clearer reporting.

We worked with an Austin app developer whose early financials were difficult to interpret because personal and business expenses were mixed. Once separated, the company’s financial picture became much more straightforward for internal planning and investor review.

Outsource Early Instead of DIYing Forever

Many founders begin with DIY bookkeeping to reduce costs, but as transactions increase, maintaining consistency can become challenging. Outsourcing the work to a CPA-led team may support:

- More consistent and organized financial records

- Timely monthly reports

- General tax planning awareness

- Clearer reporting that can be referenced in investor discussions

A Houston logistics startup we supported transitioned from spreadsheets to outsourced accounting. The resulting clarity helped them prepare the financial information needed for their credit discussions.

Prepare for Texas Franchise Tax Early

In Texas, most businesses must file a franchise tax report annually, even those with low or no taxable revenue.

Missing the reporting deadline may result in administrative penalties.

Staying organized from the beginning may help your accounting records align with Texas Comptroller expectations, especially regarding revenue categorization and supporting documentation.

Our tax planning services may help founders understand these requirements and keep financial data aligned with state rules.

Use Financial Statements to Guide Decisions

Financial statements, such as the profit and loss report, balance sheet, and cash flow statement, are valuable tools beyond tax purposes. Regular review may help you:

- Monitor gross margins

- Review receivables and payables

- Notice changes in operating expenses

We worked with a contractor whose revenue appeared strong, but margins were decreasing. Through Financial Reporting & Analysis, we helped bring attention to rising subcontractor costs, which the contractor later reviewed as part of their pricing and vendor planning.

Why CPA-Led Advice Matters for Early-Stage Founders

Startups often have a unique mix of pre-revenue operations, equity structures, and evolving financial needs. A CPA can help founders understand:

- How compensation choices (salary/draws) may affect taxes

- How to track early equity issuance and option grants

- How financial data may be organized for general business presentations

- How to stay aligned with general tax requirements from launch

At Dabney Tax & Accounting Services, we focus on helping founders understand their financial position so they can make informed decisions at each stage.

Final Thoughts

So, what are our accounting tips for startups? We always tell startup owners to focus on building systems that support progress.

Strong accounting systems can play a meaningful role in helping Texas startups avoid common pitfalls. By maintaining clean records, tracking burn rate, and separating finances, founders may support long-term business stability over time.

If you’re a Texas startup owner looking to understand how professional accounting support may help you establish a strong foundation, contact Houston accounting services to review your financial situation and discuss the considerations involved.

Frequently Asked Questions

How do startups handle accounting?

Startups often begin by opening a business bank account, using accounting software, recording all transactions, and keeping personal and business expenses separate. Some choose to work with CPA-led services for added consistency and tax compliance support.

What are the four golden rules of accounting?

They are traditional debit and credit principles taught in accounting. For startups, the practical focus is often on clean records, cash-flow tracking, timely filings, and clear expense categorization.

What are the five basic accounting principles?

Common principles include revenue recognition, matching, cost, full disclosure, and going concern. For early-stage companies, understanding revenue and expense timing may be especially helpful.

Is a CPA worth it for a small business?

A CPA may help with tax planning, reporting, and business financial organization. Many founders find value in having expert support as they scale.

How do you prepare financials for a startup?

Record all financial activity in accounting software, generate monthly statements, track burn rate and runway, and consider working with professionals to support organized records and compliance.