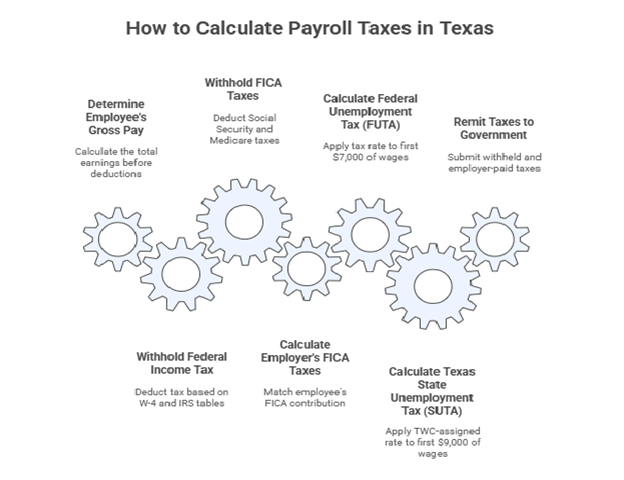

For many Texas business owners preparing to hire their first employee, one of the earliest questions is how to calculate payroll taxes in Texas. While the process may feel complex at first, it becomes manageable once you understand each component involved in a paycheck.

As a Houston CPA firm, we regularly assist new employers with payroll setup. Although Texas does not have a state income tax, which simplifies one part of payroll, federal withholding and employer-paid unemployment taxes still require careful review and consistent administration by employers. Understanding both your withholding duties and your employer tax obligations is essential for consistent payroll management.

It helps to think of payroll in two parts:

- Taxes withheld from the employee’s pay, and

- Taxes the employer pays separately.

Here’s a breakdown to help you understand how payroll taxes apply to Texas employees.

How to Calculate Taxes Withheld from the Employee’s Paycheck

Employee withholding determines the worker’s net (take-home) pay. As the employer, you are responsible for accurately calculating and withholding these amounts every pay period.

Federal Income Tax Withholding

Federal income tax is typically the largest and most variable portion of employee withholding. It is not a flat rate. Withholding is based on:

- The employee’s Form W-4

- The IRS income tax withholding tables for the current year

The Form W-4 determines filing status, dependents, and any additional amounts the employee requests to be withheld. Employers must use this information and IRS guidance to calculate the correct federal withholding for each paycheck.

FICA Taxes (Social Security & Medicare)

FICA taxes are shared equally between the employee and the employer.

Employee portion you must withhold:

- Social Security: 6.2% on wages up to the annual limit ($168,600 for the current year)

- Medicare: 1.45% on all wages, with no income cap

This totals 7.65%, which employers are responsible for withholding from the employee’s gross wages under IRS rules.

How to Calculate Employer-Paid Payroll Taxes in Texas

We often see that most new employers in our payroll services Houston, TX miss this part. These are direct costs to your business and must be budgeted into hiring expenses.

Employer Match for FICA

Employers are generally required to match the employee’s FICA contributions as outlined under IRS rule:

- 6.2% Social Security

- 1.45% Medicare

This means the combined FICA cost is generally 15.3%, split evenly between employer and employee.

Federal Unemployment Tax (FUTA)

FUTA helps fund the federal unemployment system.

- Standard rate: 6.0% on the first $7,000 of wages

- Texas employers may receive a 5.4% credit when SUTA is paid on time, depending on federal rules in effect for the year.

For most businesses, this results in a maximum annual FUTA cost of $42 per employee.

Texas State Unemployment Tax (SUTA)

SUTA is the primary Texas payroll tax employers must pay.

- Applied to the first $9,000 of each employee’s wages annually

- Tax rate varies by employer, assigned by the Texas Workforce Commission (TWC)

- New employers generally receive an industry-based average rate

Because this rate varies by employer, periodic review of TWC notices is essential.

A Sample Texas Paycheck Calculation

Let’s walk through a simplified example to see how to calculate payroll taxes in Texas for one pay period.

Scenario: Employee in Houston earns $2,000 gross for a bi-weekly pay period.

| Description | Employee Withholding | Employer Taxes | Notes |

| Gross Wage | $2,000.00 | Starting point | |

| Federal Income Tax | ($150.00) | Example based on W-4 | |

| Social Security (6.2%) | ($124.00) | $124.00 | Employer matches employee |

| Medicare (1.45%) | ($29.00) | $29.00 | Employer matches employee |

| SUTA (Example: 1.0%) | $20.00 | Rate varies by business | |

| FUTA (0.6%) | $12.00 | Employer-only tax | |

| Totals | |||

| Employee Take-Home Pay | $1,697.00 | Gross minus withholding | |

| Total Employer Cost | $2,185.00 | Includes employer-paid taxes |

This example illustrates how payroll taxes may affect both the employee’s paycheck and the employer’s overall payroll expenses.

Final Thoughts

Understanding how to calculate payroll taxes in Texas is essential for organized payroll processing and long-term compliance. While the absence of a state income tax simplifies one part of payroll, federal withholding, FICA matching, and Texas unemployment taxes remain critical responsibilities for employers.

Proper payroll setup may help reduce the likelihood of costly errors, reduce administrative stress, and help with organized reporting throughout the year.

If you’re a Texas business owner looking for support in establishing a compliant payroll process, the CPA-led team at Dabney Tax & Accounting Services can assist you in reviewing payroll requirements and maintaining organized payroll records.

Frequently Asked Questions

1. How do I calculate payroll taxes in Texas?

Calculate employee withholding for federal income tax and FICA (7.65%), then compute the employer’s share of FICA (7.65%) plus FUTA and SUTA taxes.

2. What percentage is taken out of a paycheck in Texas?

Texas does not have state income tax. Employees typically see 7.65% withheld for FICA, plus their individualized federal income tax withholding.

3. What is the formula for calculating payroll?

Net Pay:

Gross Pay – (Federal Income Tax + Employee FICA)

Total Employer Cost:

Gross Pay + Employer FICA + FUTA + SUTA

4. How do payroll taxes work in Texas?

Employers withhold federal taxes from the employee and pay their own employer-side taxes, including FICA, FUTA, and Texas SUTA.

5. How much is take-home pay on a $70,000 salary in Texas?

It varies based on the employee’s Form W-4 selections. FICA withholding applies, and federal income tax depends on the individual’s filing status and withholding choices.