For many Texas real estate investors, the goal is to build a portfolio of reliable, cash-flowing properties. But that goal can become harder to reach when financial information is scattered across spreadsheets, personal accounts, or unorganized receipts. That’s where structured bookkeeping for real estate investors may become an essential part of reviewing the financial activity of each property.

At our Houston CPA practice, we often explain to clients that effective bookkeeping isn’t just about preparing for tax time. It can serve as a financial dashboard that offers a clearer view of your portfolio, property by property.

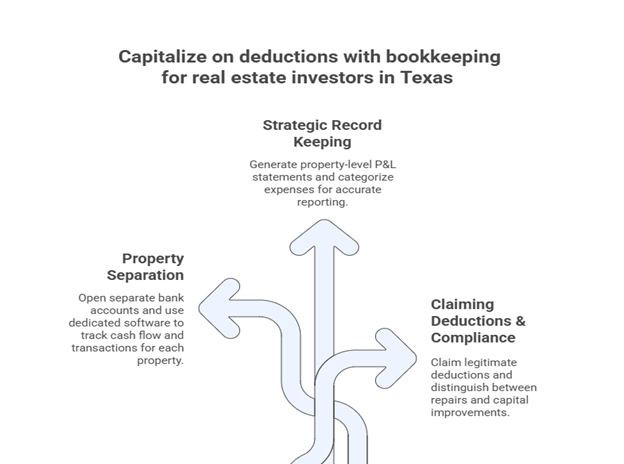

This guide provides a CPA-led overview to help real estate investors set up a professional, organized system for tracking income, expenses, and property-level financial activity in a way that supports clearer decisions.

A Property-by-Property Approach for Real Estate Bookkeeping

One of the most common issues we see is tracking all properties together, which can make it harder to review the financial activity of each property. Creating organization early may help investors see differences in financial activity and understand where further review may be helpful.

Here are two helpful early steps:

1. Open a Separate Bank Account for Each Property

Many investors open separate bank accounts or clearly segmented tracking systems for each property. Keeping rental income and expenses organized by property may help make reconciliation, reporting, and year-end tax preparation more straightforward.

2. Choose the Right Accounting Software

While spreadsheets may work temporarily, dedicated platforms, such as QuickBooks or solutions designed for rental properties, allow you to tag transactions to each specific property. This can support more consistent property-level reporting.

Clear separation at the bookkeeping level gives you a more organized view of monthly performance and may help you make informed decisions about your portfolio.

The Essentials of Bookkeeping for Real Estate Investors

Once a system is in place, you can generate financial reports that provide visibility into each property’s financial activity.

One of the most useful reports for bookkeeping for real estate investors is a property-specific profit and loss statement. This allows you to see income, operating expenses, and net operating income at a glance.

Here’s how this looks in practice, comparing two different rental properties in a hypothetical example for illustration.

| Metric | Property A (Houston Duplex) | Property B (Dallas Condo) |

| Gross Rental Income | $3,000 | $2,200 |

| Operating Expenses | -$1,200 | -$1,300 |

| Net Operating Income | $1,800 | $900 |

| Mortgage (P+I) | -$1,400 | -$700 |

| Monthly Cash Flow | $400 | $200 |

This simple comparison may help investors see differences in monthly cash flow between properties. A detailed cash-flow statement can further clarify monthly inflows and outflows.

How Clean Records Support Your Tax Strategy

Disciplined bookkeeping for real estate investors may also help support truthful tax reporting. Categorized records can make it easier to review categories of expenses that the IRS generally allows as deductions, including mortgage interest, property taxes, repairs, maintenance, insurance, and property management fees.

Organized records also support distinguishing between repairs and improvements — which can affect tax treatment under IRS guidelines. Clear documentation may help your tax professional determine the appropriate treatment. This distinction can influence tax treatment, so clear documentation may be helpful.

Case Study: An Austin Real Estate Investor

We recently worked with an Austin-based investor who managed several properties using a single spreadsheet. Because expenses were grouped together, it became difficult for him to determine differences in activity between properties or understand how certain expenses were categorized.

After organizing his books using accounting software and reviewing property-specific data, he was able to review prior-year expenses more clearly and better understand how they were categorized for tax purposes. The improved clarity also made it easier for him to prepare documentation needed for his financing discussions on a future property.

This experience shows a situation many investors face when bookkeeping becomes more organized.

Final Thoughts

For real estate investors, effective bookkeeping isn’t limited to data entry. It’s part of a financial system that can offer clarity around property-level financial activity. By organizing records by property and choosing tools that support tracking, investors may gain clearer visibility into cash-flow activity, expenses, and long-term financial trends.

If you’re a Texas investor looking to improve the organization of your financial records, the CPA-led team at Dabney Tax & Accounting Services can help you understand key considerations and build a system that supports your record-keeping needs.

Frequently Asked Questions

1. How do you do bookkeeping for real estate?

Many investors begin by separating property income and expenses, using accounting software, recording transactions regularly, and reviewing property-specific reports. A CPA or bookkeeper may help maintain consistency and provide a clearer view of your financial records.

2. What is the 3-3-3 rule in real estate?

The “3-3-3 rule” is a rule of thumb some flippers use when evaluating deals. It is not an accounting or tax standard, but more of a general acquisition guideline.

3. Do real estate agents need a bookkeeper?

Real estate agents often operate as independent businesses and may benefit from bookkeeping support to track income, expenses, commissions, and quarterly estimated taxes.

4. Is QuickBooks good for real estate investors?

QuickBooks and similar platforms may work well for investors, especially when using features that track each property separately.

5. What is the 7% rule in real estate?

The “7% rule” is a budgeting guideline some landlords use to estimate maintenance costs. Actual expenses vary, so property-specific bookkeeping may paint a more realistic picture of each property’s upkeep patterns.